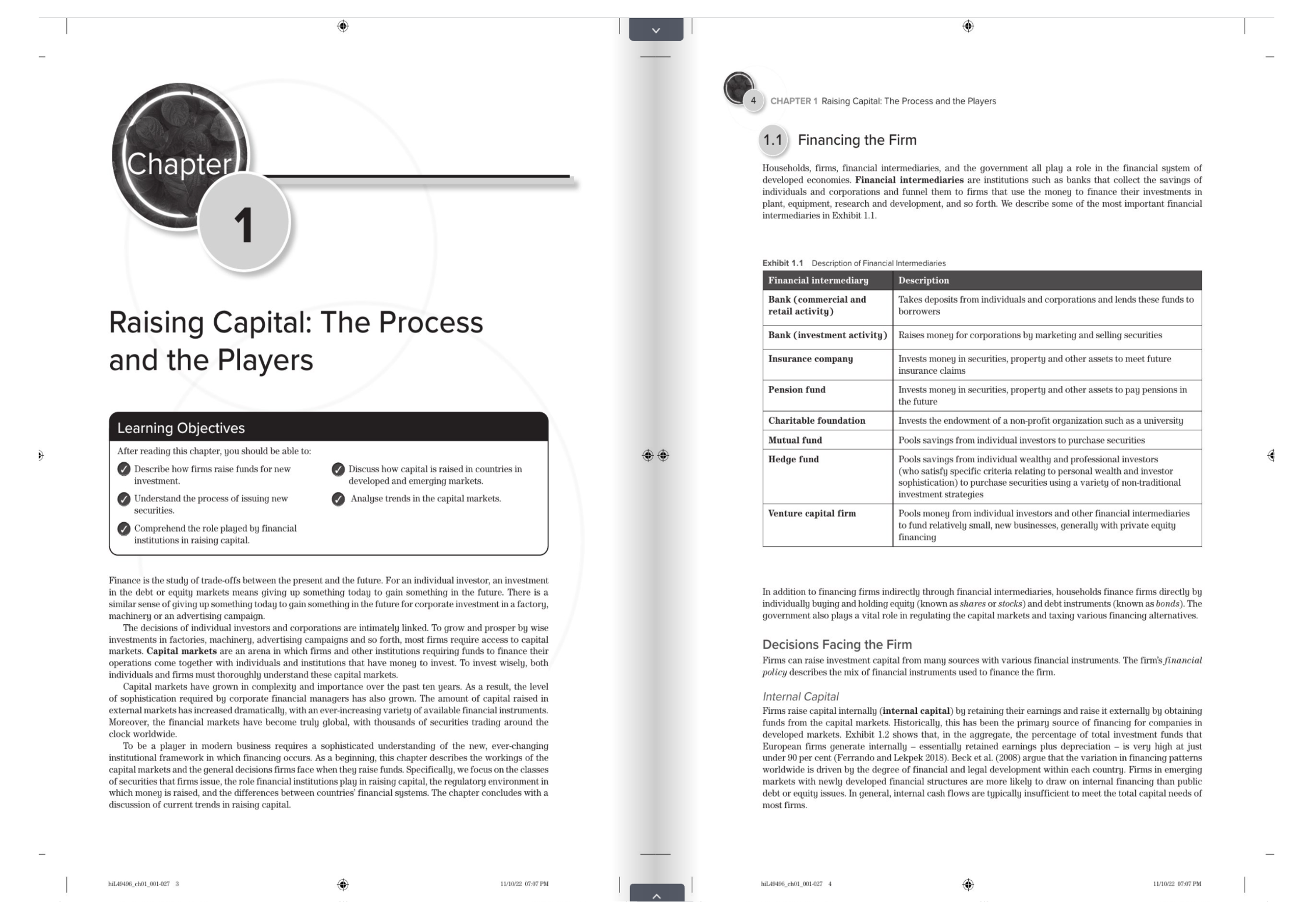

David Hillier, Mark Grinblatt, Sheridan Titman

Print ISBN: 9781526849496 Ebook ISBN: 9781526849502

The global pandemic restrictions, climate change, geopolitical tensions, and new

artificial technologies have fundamentally impacted international financial

markets and corporate strategy. Traditional finance theories have been

questioned and their application to corporate decision-making has come under

scrutiny like never before.

The third edition of Financial Markets and Corporate Strategy provides students

with comprehensive and engaging discussions on the strategic challenges

facing companies and their financial decisions. Brought to life by real-world

examples, international cases and insights from recent research, it guides

students through the challenges of studying and practising finance from both an

academic and practical viewpoint.

What's new

Fully Updated

- Coverage of the most critical topics today, with updated data and examples in every chapter.

- There are updates on accounting standards, bankruptcy laws, tax rules and tax systems.

- Most chapters have been updated with new research published in the top journals since 2012 - references to the most cited journal articles appear in a list at the end of each chapter.

Current Issues and Hot Topics

- Coverage of the impact of climate change, Brexit, the economic growth of China, and new financial technologies

- Chapters on financing, equity and debt markets have been overhauled to bring them up to date with the latest economic paradigm in which corporations operate.

- A stronger emphasis on sustainability, ethics, and corporate governance.

Unique in scope and approach

- Written for a European audience with a wide range of real-world examples, international cases and insights from Europe and across the globe.

-

An advanced text that is designed specifically for upper level corporate finance related courses.

-

Guides students through the challenges of studying and practising finance from both an academic and practical viewpoint.

About the authors

David Hillier

David is a Professor of Finance, Executive Dean of Strathclyde Business School, and Associate Principal of the University of Strathclyde.

A Professor of Finance, David was recognised as in the top 3 per cent of the most prolific finance researchers in the world over the past 50 years (Heck and Cooley, 2009) and appears regularly in the media as a business commentator.

David has acted as a World Bank consultant and provided consultancy advice to the NHS and several international stock exchanges.

Mark Grinblatt

Mark is the J. Clayburn LaForce Professor of Finance at the UCLA Anderson School of Management.

Sheridan Titman

Sheridan is a Professor of Finance at the McCombs School of Business.